Your First Home is Closer than You Think

Thinking about buying your first home is exciting. Imagine: No loud upstairs neighbors, no asking to paint – just you and a place to be yourself. Whether you’re just starting to look into what’s possible, or you’re ready to buy now, UW Credit Union’s friendly, local experts can help guide you through the homebuying process from start to furnish.

I want to buy a house. Where do I start?

- Learn how the process works

- Get familiar with types of home loan options

- Explore down payment saving strategies

I’m ready to buy a house. What should I do?

- Calculate how much you can afford & apply to get preapproved

- Get details about specific home loans

- Connect with our local lending team

Looking for our current home loan rates?

View and compare rates on different loan options.

30-Year Fixed Rate Purchase

15-Year Fixed Rate Purchase

Opening the Door to Homeownership for First-time Buyers

Buying your first home means being prepared. Whether you just want to talk to someone about the process or want help getting your debt under control, UW Credit Union’s experienced team of local home loan experts and financial specialists have your back.

We can help with:

Mortgage Readiness Conversations

- Look at your current debt and credit situation

- Talk through ways to improve your financial position

- Help find the program or loan and rate that fits your situation

Improving your Debt-to-Income Ratio

- Understand debt consolidation options

- Identify changes in your financial strategy that could lead to more financial security

- Create a budget that helps you pay off debt

Credit Repair

- Explore approaches to managing debt that could help increase your credit score

- Discuss debt restructuring options like changing credit cards to installment loans, like personal loans, for example

- Talk through how credit reports work and strategies you can use to improve your score

Down Payment Sourcing

- Explore options to avoid PMI (Private Mortgage Insurance), lower monthly payments, and more attractive loan types

- Identify the best path for your situation and objectives

- Identify down payment assistance programs you may qualify for

Source, 2024 UW Credit Union Annual Report+

First-Time Buyers Guide

Explore Our First-Time Homebuyer Guide

Do you know why your credit score matters when buying a home or what to expect during closing? Dive into our First-Time Homebuyer Guide to find out!

Upcoming Events

Get Answers from Home Loan Experts

If you’re wondering how preapproval works, or how to get started in the first place, our FREE, no-obligation info sessions and webinars are perfect for first-time homebuyers.

Home Loan Options

When it Comes to Home Loans You Have Choices

From fixed-rate and adjustable-rate loans, 15-year to 30-year,* you have a lot of options. Explore the variety of home loans available from UW Credit Union.

Programs to Make Home Buying More Attainable

Affordable lending programs for first-time homebuyers can help make purchasing your home a little easier. More home buyers qualify than you might think!1

We’re proud to offer affordable lending options like WHEDA loans, HomeReady®, Home Possible® as well as down payment assistance programs.

Talk to one of our local experts to find out more about affordable lending and whether you qualify.

Proud Community Partners

We partner with these organizations to help our communities thrive.

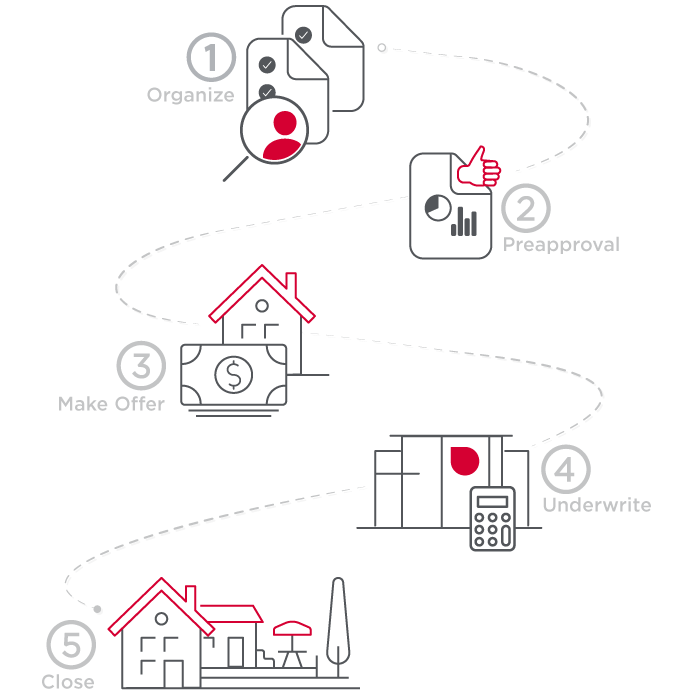

How the Homebuying Process Works

Buying a home is a complicated transaction, but it doesn’t need to be a mystery. Here’s a quick look at what to expect and some things you’ll need to do as you prepare to buy your home.

-

1 Organize your Personal InformationHave your personal information like employment details and income ready. You’ll need it for you and anyone you’re purchasing your home with.

-

2 Apply to Get PreapprovedGetting preapproved gives you a better understanding of how much home you can afford. Start by filling out an application online.

-

3 Shop & Make an OfferNow the fun starts! Hit those open houses, find your dream home and make an offer.

-

4 Processing & UnderwritingOnce you’ve made an offer your preapproval becomes an official application and is processed by our mortgage team.

-

5 ClosingHere’s where you sign the paperwork and pay the down payment and closing costs. Celebrate – You’re now a homeowner!

6 Popular Questions from First-Time Homebuyers

Not sure what closing costs are all about or how to know how much you need for a down payment? Don’t worry – you’re not the only one. Take a look at these common questions and our answers.2

Calculators

Do the Math

Use our free calculators to get a better idea of what mortgage payments look like, compare renting vs. buying and more.

Articles

Take a Closer Look

Get tips for home shopping, get a deeper understanding of the homebuying process and boost your home buying smarts.

FAQs

Get More Answers

See answers to commonly asked questions about home loans, mortgages, down payments and more.